Strong financial performance

Grünenthal's financial performance in 2024 demonstrated resilience and stability, navigating challenges and capitalising on opportunities to maintain robust results.

Maintaining record 2023 levels, revenue reached €1.8 billion, with an adjusted EBITDA of €412 million, underpinned by strong Qutenza growth and strategic acquisitions offsetting the impact from the first full year of loss of exclusivity for Palexia.

Robustness and commitment

in € million |

Actual 2023 |

Actual 2024 |

|||

| Revenue** | 1,819 | 1,798 | |||

| Cost of sales*** | -625 | -669 | |||

| Gross profit# | 1,194 | 1,129 | |||

| Marketing, Sales & Medical costs## | -519 | -504 | |||

| Core Research & Development costs | -162 | -179 | |||

| Other costs | -325 | -342 | |||

| Depreciation Fixed Assets### | 202 | 246 | |||

| EBITDA | 390 | 349 | |||

| Adjusted EBITDA+ | 427 | 412 | |||

| Earnings before taxes | 123 | 32 |

* Management view Profit and loss statements (P&L) can be displayed in Accounting and Management view. Both P&Ls include the same information, but are designed to serve different needs. The Accounting P&L is used for reporting according to German Commercial Code (HGB) while the Management P&L is used for internal steering and tracking. Both views are similar for Revenue, Cost of sales and thus Gross profit. But they differ in terms of the recognition of depreciation on acquired product rights and medical affairs costs. Depreciation of acquired products rights are recognised in Management view as part of “other costs” whereas Accounting view shows it as part of “selling expenses”. Medical commercial R&D costs comprise post approval product costs, e.g. for the maintenance of registration, for clinical studies for Phase IIIb/IV and the support of investigator initiated studies as well as structural costs. These costs are part of “Marketing, Sales & Medical costs” in Management view whereas shown as “Research & Development costs” in Accounting view

** Revenue primarily comprises sales of products and revenue from licensing, as well as milestone payments. It also includes service income from our contract manufacturing business, such as customer refunds for the purchase of machines required to produce a certain product or for customisation of product formulations

*** Cost of sales are any costs that can be directly associated with products sales

# Gross profit reveals how much money a company earns taking into consideration the costs that it incurs for producing its products and/or services

## Marketing, Sales & Medical costs consists of all costs to promote, sell and distribute our products to the customer. This excludes depreciation on acquired products which is part of “other costs”

### Depreciation of machines, IT equipment and several other items is an incremental part of CoGs, Marketing, Sales and Medical costs, R&D costs. In order to derive the Earnings before interest, taxes, depreciation and amortisation (EBITDA), it needs to be added back

+ Adjusted EBITDA, short for adjusted Earnings Before Interest, Taxes, Depreciation and Amortisation, is a key performance indicator for the Grünenthal Group. It is calculated by adjusting the operating result for amortisation, depreciation and impairment and special effects, in particular from restructuring and acquisition-related expenses

Corporate profile

Grünenthal is a science-based, fully-integrated pharmaceutical company headquartered in Aachen, Germany. We have affiliates in 28 countries across Europe, Latin America, and the US. We employ around 4,300 people and our products are available in around 100 countries. Everything we do is focused on driving progress toward our vision of a World Free of Pain.

Annual Report 2024/25

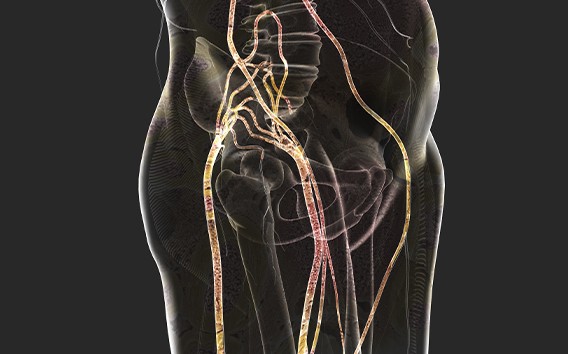

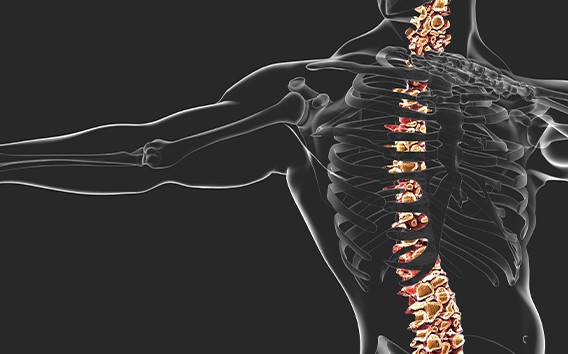

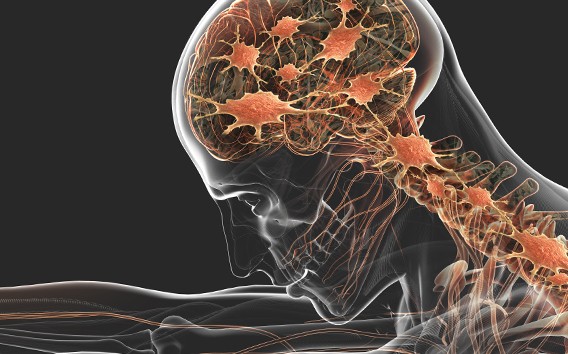

Pain represents a huge burden for people and society, and the unmet medical need remains high. Addressing the unmet medical need in the treatment of all types of pain and finding and developing new treatment options to try to break the cycle is what drives our strategy. As a global leader with a unique position in pain research and management, we want to create a positive impact for society. It is due to this potential to improve the lives of patients in real need that we are committed to delivering on our vision of a World Free of Pain.

”As one of the world’s leading specialists in the therapeutic area of pain, we aim to create sustainable value. Everything we do is focused on driving progress towards our vision of a World Free of Pain.”

Being a responsible business and leader in ESG in our industry

Conducting business responsibly is a central element of our strategy and culture. We aspire to create a positive impact for society – with and beyond our core business. At all times, everything we do is guided by integrity, transparency and the highest ethical standards. Our industry-leading way of doing business responsibly is reflected in our external Environment, Social and Governance (ESG) ratings.

Our Corporate Responsibility Programme

Compliance and transparency

“(p) AA” ESG rating

ESG risk rating

Responsibility Report 2024

Opioids

Patents

Our R&D pipeline

Our product range

-

1 Disclaimer

The MSCI Provisional ESG Rating and related report and research (collectively, the "Provisional Rating"): (1) was prepared by MSCI ESG Research for compensation, (2) is not a credit rating or securities research report, (3) is made available only for informational purposes and without any warranty or guaranty of accuracy, quality, completeness or usefulness, (4) is current only as of the date first issued and is subject to modification and withdrawal without notice, (5) does not, and is not intended to, constitute an investment promotion, report or opinion of an expert, assurance letter, part of any offering, or any offer or recommendation to purchase or sell any securities, credit commitments or other assets or to enter into any project or business transaction in connection with the rated company or otherwise, (6) is based in whole or in part on information provided to MSCI ESG Research by or on behalf of the rated company, which MSCI does not validate for reliability, truthfulness, accuracy, completeness or otherwise at any time or over time, (7) is based in whole or in part on non-public information and may differ materially from a subsequent Provisional Rating or standard ESG Rating assigned by MSCI ESG Research to the rated company, (8) may not incorporate or accurately reflect actual environmental, social or governance-related risks and information relevant to the rated company, (9) has not been submitted to, nor received approval from, any relevant regulatory bodies, and (10) may not be altered or modified, further copied or redistributed, or used to create derivative works, indexes, databases, risk models, analytics, software or other works or to train any large language model or other artificial intelligence system without the express prior written permission of MSCI ESG Research. MSCI ESG Research shall have no liability with respect to the Provisional Rating or any use thereof, including, without limitation, with respect to any use of the Provisional Rating in connection with any investment or any other purpose. All uses of the Provisional Rating are also subject to the disclaimer located at: msci.com/legal/provisional-rating, which may be updated by MSCI from time to time.